Is the Dollar in Danger?

You may be hearing that the dollar has outlived its usefulness as the world’s reserve currency, and that recent events (the recent threat in Congress of defaulting on U.S. debt, the U.S. summarily seizing assets (of Russian oligarchs) without due process) are contributing to the decline. Other options have been proposed, like bitcoin, euros or the Chinese renminbi.

The truth is, it’s highly unlikely that the dollar will be replaced in the foreseeable future. The dollar currently represents more than half of the world’s foreign exchange holdings (58% as of the end of December), and more than 90% of global trade occurs in greenbacks. People prefer transaction in dollars is because the U.S. economic system employs a strong rule of law that protects property rights and enforces contracts—another way of saying that foreigners are protected when they transact in dollars, something they cannot say with certainty if they’re buying or selling in crypto or renminbi. Another reason the dollar dominates is because the U.S. bond market, which is denominated in dollars, is by far the largest in the world, which means international trade is provided with immense liquidity.

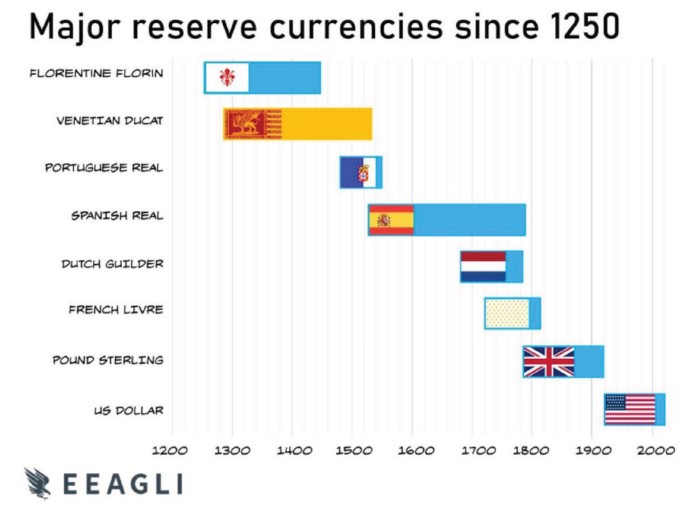

But a currency’s life as the world’s favorite can be limited, as you can see on the accompanying chart. We no longer transaction in the Florin, and haven’t since the 1400s. The Dutch Guilder hasn’t been the global standard since the late 1600s, and Britain’s pound sterling gave up the reserve mantle in the 1920s. It won’t happen soon, but history suggests that something will come along eventually to become the new reserve currency, and history suggests that whatever country issues it will finally replace the U.S. as the next economic superpower.

Sources:

https://www.advisorperspectives.com/articles/2023/04/12/the-dollars-death-not-so-fast-part-one