Money Supply vs. Inflation

People who worry about inflation taking off and devaluing our currency typically point to the idea that the government is frantically printing money. Of course, the money supply doesn’t increase due to printing presses working overtime; in these modern times, the U.S. Federal Reserve Board—our nation’s central bank—increases the money supply with simple keystrokes. Its policymakers create new money by simply decreeing that lending institutions can lend more money per physical dollar they hold in deposits. The Fed can lower interest rates, which makes it more likely that borrowers will want to take out those loans. And perhaps most directly, the Fed can buy Treasury Bonds on the open market, which immediately puts more cash into the system.

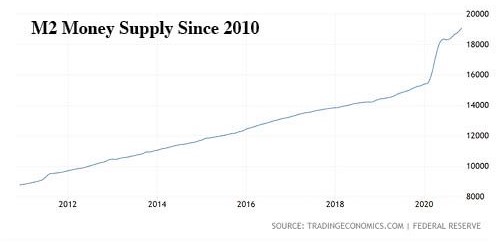

Chances are, you know that the Fed has been doing all three of these things as a way to ease the economic damage caused by the global pandemic. But is this actually raising the money supply in any dramatic way?

It is. The chart shows that since 2010, the total money supply (known as M2 in economic circles, adding together cash, checking deposits, savings deposits and money market securities) had been going up pretty steadily, which in itself is remarkable, since, during that time, inflation has been consistently low. But notice that since February 2020, the money supply has changed course—rising, in less than a year, from less than $16 trillion to something over $19 trillion. Year over year growth exceeded 23%—and Fed records show that one-year growth has ever before been higher than 15%.

Will this lead to more inflation? Classical economics tells us, reasonably, that if the money supply grows faster than the actual economic output, there will be more dollars per things to buy—that is, there will be more money available to buy all the things that are for sale in the economy. That, in turn, suggests that prices will rise, which is the definition of inflation.

But in our real world, the inflation rate has been consistently below 3% over the past decade, and this year it dipped down near 0%. What’s stopping inflation from taking off? While the Fed has encouraged banks to lend money, and made rates attractive, the slow economy in 2020 means that companies are not as eager to borrow as they might be in more normal times. Banks are holding a lot of reserves at the moment. If that money ever finds its way into the economy, and a stimulus package creates a new cohort of willing spenders, then we could see inflation rates go up—perhaps dramatically.

Sources:

https://tradingeconomics.com/united-states/inflation-cpi