Life Expectancy and Retirement Savings Go Hand in Hand!

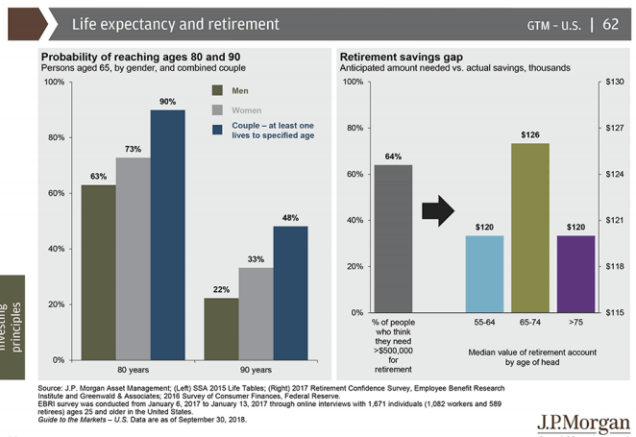

When we run long-term projections for folks, we regularly assume 95 years will be their life expectancy. You should see some of the looks we get! Almost everyone laughs and says there is no way they will make it to age 95. However, statistics show that a 65-year-old couple has a 90% chance that one of them will be alive at age 80 and nearly 50% chance that one of them will still be alive at age 90!

Keep in mind that the data on the left side of this graph is put together by the Social Security Administration, so it is a sample set of the entire population!

Do you go to the dentist regularly? Dr. David Cleveland at Darby Creek Dental shared that more than 1 in 5 Americans hasn’t seen a dentist in more than 3 years! Do you wear your seatbelt? According to the National Highway Traffic Safety Administration, 27 million Americans still do not! Do you have access to quality healthcare? What about the ability to buy quality fresh foods? If you answered yes to any of the above, you are likely to have a longer expectancy than the average American.

So again, we ask…is 95 absurd?

How long of a retirement should you plan for? Can you change your life expectancy?

The obvious answer is to look at longevity in your family history. If both of your parents lived into their 90s and were physically and mentally healthy, you have a pretty good chance to be looking towards that centenarian mark. If you want some tips directly from the Centenarian’s themselves, then read this article from PBS or watch this video from Sharp Health.

Ok, so what about you?!? Try taking the test at www.livingto100.com that will ask some specific health questions and compare your estimated life expectancy to the average. It will also recommend life changes and will show how those changes can impact your longevity.

What age did you get?