Bankruptcy Anomaly

You’re probably thinking that the 2020 pandemic environment created a massive flood of commercial bankruptcy filings, perhaps unprecedented since the Great Depression. There have been a number of high-profile filings from well-known companies like Hertz, Neiman Marcus and JCPenney.

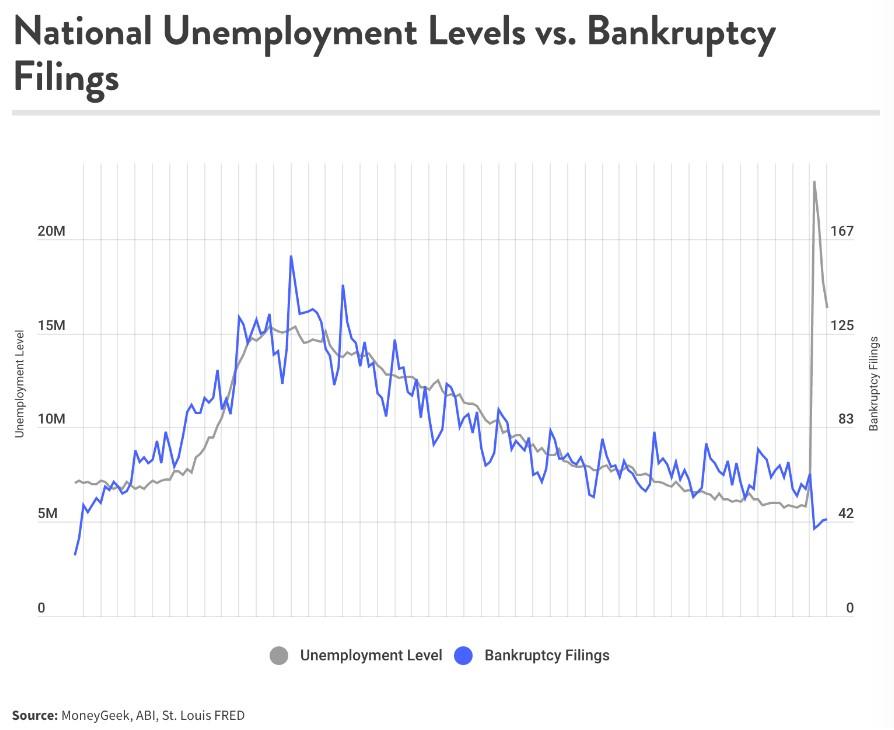

But the surprising truth is that bankruptcy filings, overall, are actually down from recent averages in the U.S. economy. The chart included here tracks the total number of commercial bankruptcy filings (blue line) since January 2006. You can see the Great Recession peak toward the middle left side of the graph, which is somewhat jagged since this is monthly data. To the right, you can see that the bankruptcy numbers have been trending downward ever since, and seem unaffected by the pandemic.

Will that last? The graph also shows the number of unemployed Americans for each month over the same time period, and you immediately see how closely these fluctuating unemployment numbers track the fluctuations in the bankruptcy rate—that is, until recently. Notice that the unemployment numbers went up during the Great Recession, right along with the number of bankruptcies, and then declined along with bankruptcies until 2020. As the pandemic hit, suddenly there was a sharp divergence; unemployment spiked up to near-record highs, while bankruptcies continued along the same downward trend.

What does that mean? It’s never easy to predict the future, but unless there has been a dramatic uncoupling of unemployment and bankruptcy filings, we might experience a jump in businesses throwing in the towel in the first quarter of 2021.

Meanwhile, the pandemic seems to have hit some state economies harder than others. Texas and New York have experienced bankruptcy rates, since March of 2020, of 16.65 businesses per ten thousand, and 12.48 respectively, by far the highest rates, outpacing #3 Nevada (8.84 bankruptcies per 10,000 businesses), #4 Virginia (7.56) and #5 Delaware (7.01). At the other end of the spectrum, Rhode Island was experienced zero bankruptcies since March, while businesses domiciled in Connecticut (0.34), Iowa (0.36), New Hampshire (0.52) and Oregon (0.67) seem to have been strangely unaffected by the Coronavirus impact on the U.S. economy.

Source:

https://www.moneygeek.com/coronavirus/states-most-coronavirus-bankruptcies/